How does deflation effect price

7 comments

In a world built on inflation, I wanted to dig a little bit into the world of deflationary metrics

A lot of tokens have used this deflationary tokenomics to market their coin

But anyone can just claim to do something and pretend they are good. A honeypot or a rug pull is still a honeypot or a rug pull even with a deflationary token system.

When honest people are behind a project though good things can happen.

We see what lowering inflation can do to a system, it seems like every time bitcoins inflation gets cut in half we see a sharp price rise not too long afterwards

Ethereum for example, had an upgrade where they introduced coin burning

At times, ethereum's issuance becomes deflationary, meaning it is burning more than it is creating creating a net deflationary period

I imagine what if the network gets wild again? There was crypto kitties, there was airdrops galore, there was NFT's, all of which created moments where ethereum was super expensive. Super expensive because the network was busy.

Since then ethereum has been upgrading to handle more transactions, so will be interesting to see how much activity it will take to fill up the blocks again.

Now let's get to 2 coins I like very much. The reason I bring these 2 up is because they are both deflationary tokens.

There can never be any more coins minted.

Both of these coins have fees and those fees burn a lot of tokens.

These 2 coins are of course PTGC and UFO

PTGC is the main player, but UFO was created afterwards to help burn more PTGC

This post isn't about these 2, so I won't go into all the ins and outs of their tokenomics, you can scroll my account and eventually you should find that.

I chose these 2 because they are both legit products that have been around long enough to show off the chart and all that comes with it.

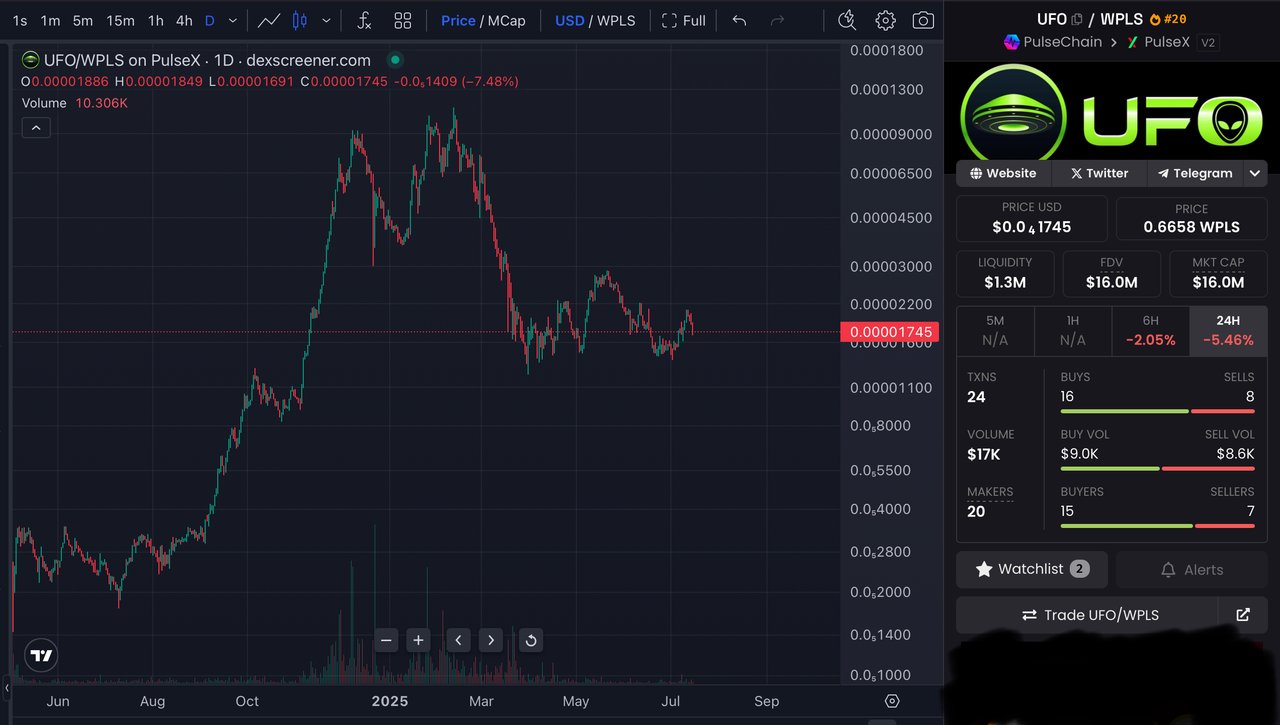

here is the ptgc price chart and after that is the ufo price chart

The reason I am showing these charts is to learn so the LEO has all the tools it needs to succeed

So, straight off the bat, I will say the lower the price the token is the more can be burnt.

So, for example, let's say there will be a $100 used to buy and burn LEO off the market. Let's exclude slippage from this example just to keep focused on the point.

If LEO is 2 cents, that $100 can buy 5000 LEO to buy and burn

However, when LEO hits $0.10, that $100 can only buy and burn 1000 LEO

and LEO at $1 means only 100 LEO will be burnt for every $100

When you introduce a daily buy and burn or buy and LP, you are creating a consistent stream of buy pressure.

Who can sell a token? well, whoever owns the token can sell the token, but how did they get it? usually, they bought it, however of course with hive and Leo you can earn them instead of buying them

With the new tokenomics LEO will be harder to earn in theory, there must be lots of different activities that are consistent and growing to sustain the system

One thing you should know about these charts, notice they are both paired with PLS

The price of PLS going down is shown in both of these charts

the premise is, when PLS starts going back up these charts will be super up and to the right just like you see in these charts

It is important for LEO to be paired with assets that we are expecting to go up

If LEO is paired with Hive it gives me less confidence because Hive still has an inflationary model. The income for a lot of users coming from new tokens and those tokens are sold on the market suppressing the prices.

I know LEODEX is working with other chains, as long as we are paired with bullish tokens I would say we are good

BTC, ETH, are bullish, making pairs with those can be good, a few HBD pairs too and other stable coins maybe Dai? so that we can give the arb bots opportunities to profit from price differences among all these different pools and rebalance them according when different tokens move in price. This will be great for volume which is where all the fees come from, which in turn creates more buy pressure and thicker LP

Looking at these 2 charts above you see there are periods of slow up, periods of fast up, periods of fast down and periods of sideways

I can tell you, slow up means the system is buying and burning tokens while the paired token (in this case PLS) is stable

Fast up means the system is buying and burning a lot while PLS is going up a lot and fast, this amplifies the gains and is the reason why both of these tokens have outpaced the native gas token, PLS

Fast down was when PLS was going down super hard, dragging down everything that its paired with. Think of what happens to the entire market when bitcoin dumps 15%... usually everything else is down over 20%, at least there is a lot of fees earned on the way down to help buy back up a bit afterwards

and the periods of sideways is actually PLS slowly going down while the PTGC and UFO system is able to buy and burn though that slow leak and keep things pretty stable

if I was to zoom in to recent times we had a recent pump because PLS was pumping but PLS cooled off however you can see both tokens are up VS pls because of their deflationary nature

Leo in this case is outperforming Hive, Hive has the power to draw LEO down but also has the power to add rocket fuel to LEO's engines

Personally, for now at least, I am seeking to grow my LEO bag

I will post as much as I can of course but all my rewards will be converted to hive and used to buy more LEO

So if you like LEO's price to go up you can support my account with a nice little upvote and be confident knowing your vote is going to pump LEO :)

Posted Using

Comments