Philippine Stock Market Analysis (As of April 12, 2025) -- Trump Tariff Uncertainty and 25Bps drop in Interest Rate

2 comments

Trump Tariff Pause for 90 days. See you on July 2025

The saga continues as the Trump administration pauses the implementation of tariffs for 90 days except for China. This helped markets bounce back right after.

Philippine Market -- Consolidation Mode

Market dropped at around 4% last April 7 in reaction to the reciprocal tariffs. However, the gap down was filled instantly in the past 2 days as the US announced some pause for now. This puts the market in consolidation mode still. Latest price action shows that there are ready buyers at these levels and any good news can spur the buying appetite of investors. Still a good time to accumulate undervalued stocks.

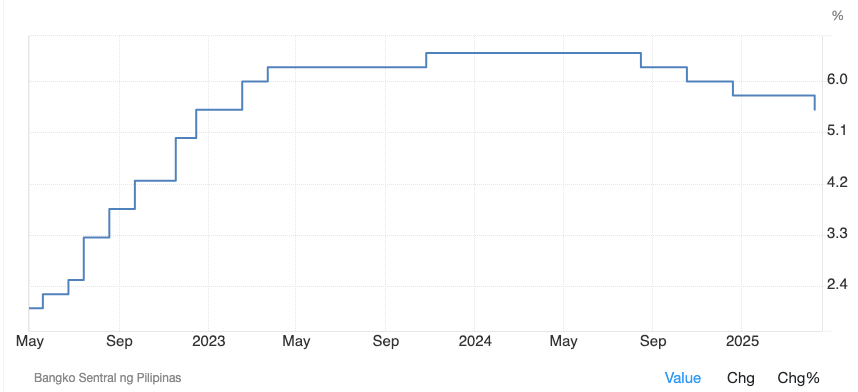

Central Bank Cuts 25bps on its Benchmark Interest Rate

As discussed in a previous post, we have enough room to lower down interest rates which helps in boosting the stock market. It has recently been announced that the Central Bank has cut interest rates by 25bps. Although the BSP's (Central Bank) approach is to use it gradually over time.

This is not financial advise. I use this as my trading journal/notes for ongoing reference for the succeeding week. The above technical analysis (charts) are just used for guidance while studying market behavior and trying my hand on market timing. Please Do Your Own Research (DYOR).

- Stock Charts from Investagrams

Comments