ETH And SOL Range-bound Increases Harvested Yields | DeFi Journey #12

1 comment

ETH and SOL played a game of in-and-out with my CLP ranges, breaking above $2.6K and $180, respectively, before dipping back down over the last two days and coming within my CLP ranges. That left me farming yields intermittently. Meanwhile, I'm keeping an eye on SUI after its recent exploit, but for now, I'm sticking to my plan, which is stacking harvested yields in USDC while I wait for clearer signals from BTC, ETH, and SOL.

The past week's ETH price action has been choppy. After breaking $2.6K, it pulled back slightly, holding above $2.5K on the weekly and daily charts. It has been consolidating after a strong move the past month, which feels positive. However, if it pushes past the $2.7K level, this will be a fundamental level to watch, which may confirm a breakout. SOL, now at $172 after touching $180, looks solid but is testing resistance around $178-180, a key level on higher timeframes. If it breaks, we could see a stronger run. BTC, hovering around $107-108K, remains the crypto market's main anchor. It is sitting just above a key resistance level of $104K on the weekly chart. If it fails to hold this week, it may drag everything down, especially with macro uncertainty like tariffs and S&P 500 volatility in play.

Overall DeFi Portfolio

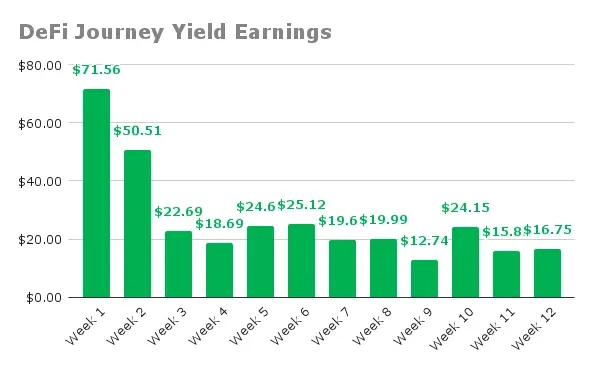

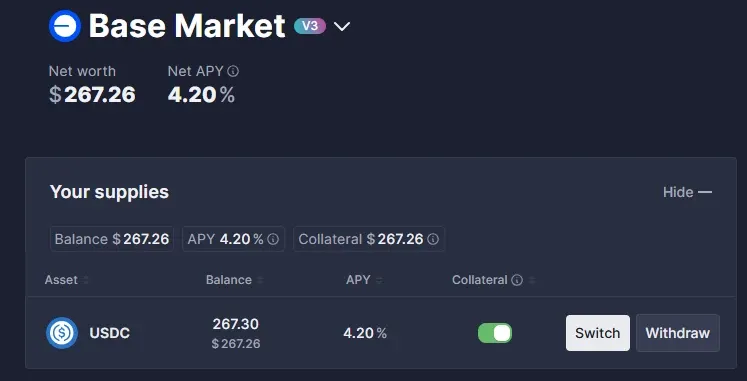

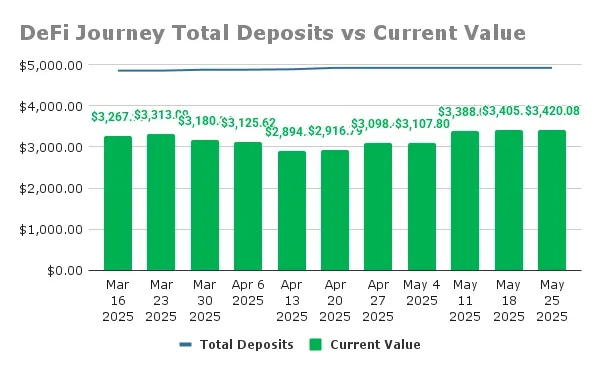

This week saw a small win for my DeFi portfolio, with harvested yields increasing to $16.75. I have supplied $16.16 of this week's yield into my AAVE USDC vault, bringing its total to $267.26. The vault's yield has been climbing steadily, now at 4.20%, and I am happy to keep parking profits there while I monitor the market. Total deposits remain unchanged at $4928.71, with the portfolio's current value at $3420.08, including the AAVE vault. Total harvested fees earned are now $537.42, and my overall loss sits at -$971.21, and it is great to see this under $1k value.

CLP - ETH/USDT - PancakeSwap, Binance Smart Chain

ETH's back-and-forth above $2.6K meant this position was in and out of range for part of the week. I harvested $6.78, bringing total rewards to $215.42. The deposit remains $2213.00, with the current value at $1343.41, yielding a 31.16% APR.

- In-Range: ✅

- Range Setup: $1204.29 - $2546.84 (75% wide)

- Rewards Farmed This Week: $6.78

- Total Rewards: $215.42

- Total Deposits: $2213.00

- Current Value: $1343.41

- Yearly APR: 32.16%

- Price Difference (Inc. Fees): -$654.17 (-29.56%)

CLP - WETH/USDC - Aerodrome Finance, Base

This position mirrored the ETH/USDT CLP pair on BSC, dipping in and out of range as ETH fluctuated. I harvested $3.53, pushing total rewards to $193.98. The deposit is still $1663.40, with the current value at $1004.25, offering a 37.27% APR.

- In-Range: ✅

- Range Setup: $1202.37 - $2545.32 (75% wide)

- Rewards Farmed This Week: $3.53

- Total Rewards: $193.98

- Total Deposits: $1663.40

- Current Value: $1004.25

- Yearly APR: 37.27%

- Price Difference (Inc. Fees): -$465.17 (-27.97%)

CLP - SOL/USDC - Orca, Solana

SOL's dip below $180 brought this position back in range after briefly breaking out. I harvested $6.44, with total rewards now at $115.78. The deposit remains $896.20, and the current value is $805.16, yielding a 49.97% APR.

- In-Range: ✅

- Range Setup: $97 - $180 (59.4% wide)

- Rewards Farmed This Week: $6.44

- Total Rewards: $115.78

- Total Deposits: $896.20

- Current Value: $805.16

- Yearly APR: 49.97%

- Price Difference (Inc. Fees): +$24.74 (+2.76%)

AAVE USDC Position

My AAVE vault now holds $267.26 after adding $16.16 from this week's yield. With a 4.20% yield, it is a steady place to park funds while I wait for a clearer crypto market direction. I can redeploy this capital quickly if BTC, ETH, or SOL show a retrace to key resistance levels.

Concluding Thoughts

This week's yield increase to $16.75 is a small victory, but ETH and SOL's range-bound action kept my CLP position going in and out of range. For now, I will keep stacking harvested yields in AAVE's USDC vault, staying liquid until I determine my next move.

Thank you for reading, and hope you have a good rest of the day!

Follow me on these other platforms where I also post my content: Publish0x || Hive || Medium || Twitter

Posted Using INLEO

Comments