How do Banks Survive Hyperinflation?

21 comments

Is that even how it works?

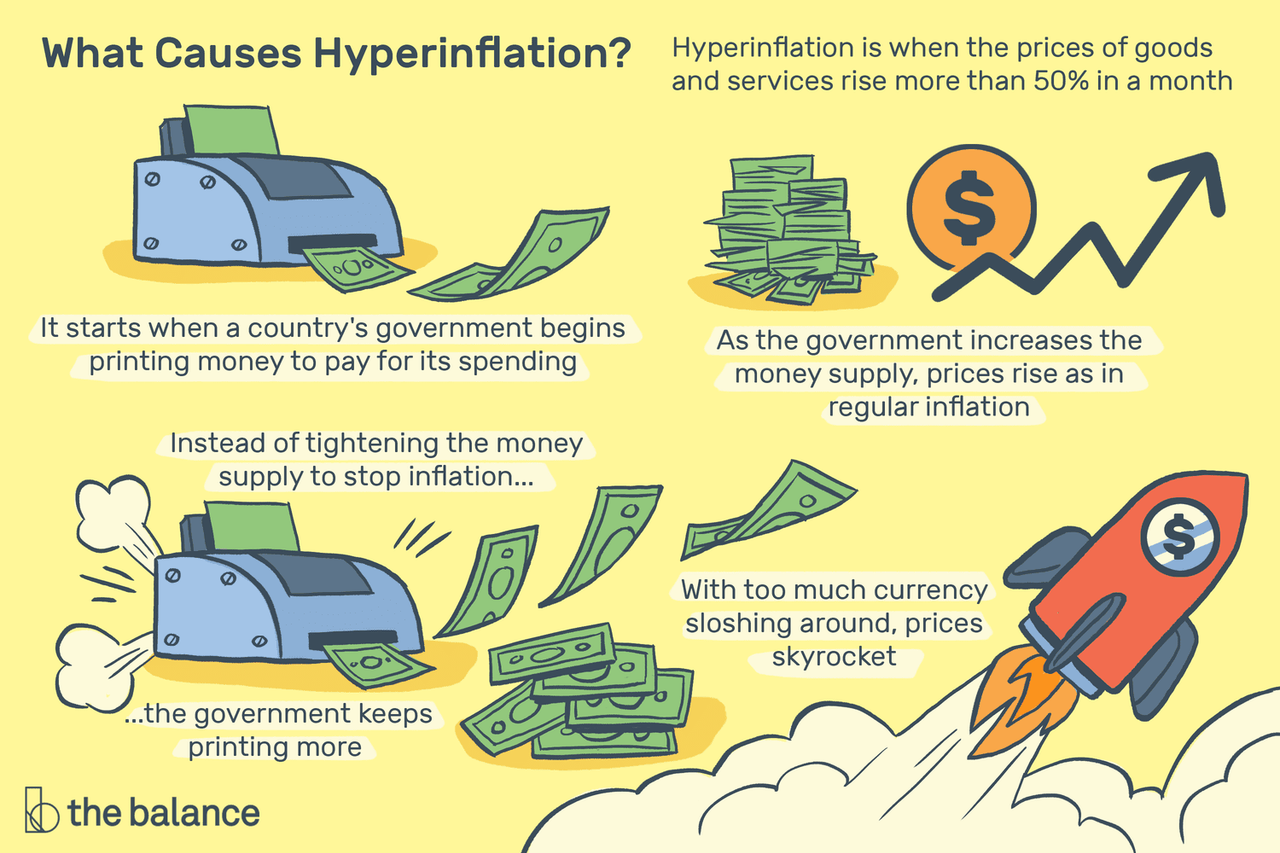

Look at the infographic above. Is that how "inflation" happens? How do we even define "inflation" when the population can't even agree on a simple definition of the word? For example: is inflation when prices of things go up, or is inflation when money get printed?

Most people when asked on the street are going to give you the wrong answer (prices going up). But if perception is reality then the wrong answer becomes the right answer, does it not? Because that's how language and communication works. The entire conversation becomes muddled and confusing right at the ground floor, and this is largely by intelligent design. THEY don't want you to know how it works.

It starts when a country's government begins printing money.

That's exactly not how it happens because governments don't print money, do they? Banks print the money, and banks are not owned by the government. Maybe the government borrowed money from the bank, and now people are dumbing down the situation to the government directly printing money, but that's not how it works. It is an onion of complexity.

In fact I assume history classes still teach that money used to be backed by gold, and students continue to assume that money is still backed by gold because that is a system that actually makes sense. Only college level economic classes will teach a student otherwise, because again the people who decide what's get taught don't want people to know how it works. This has been the strategy for over 100 years now.

The internet will tell you that banks are accountable to the government and to their civilian populations, but when is the last time you ever heard of a central bank being fined or prosecuted by the law? I don't have a memory of that ever happening, which clearly implies they are completely unaccountable.

Of course retail banks being fined is much more common, but it matters not. When any bank at the top end of the spectrum gets fined, the fine is always less than the theft, making the punishment ineffective and simply paying protection money to the government to allow them to continue operations as usual.

So how to banks survive their own unsustainable policy?

The answer is always the civilians being saddled with debt and devaluation.

But the devil is in the details.

When most people think about how a loan works, they think about it in terms of peer to peer and the thing being loaned having intrinsic value. If I loan my friend $100 and they don't pay me back... I've lost $100. If I get paid back $100 much later but the price of goods and services has doubled, I indirectly lost half of my money through a loss of purchasing power.

This is why banking is extremely confusing to the layman because banks do not operate in this manner. What we consider "money" and "value" a bank considers "debt" and "liability". If a bank loans out $1,000,000 at 5% interest over 30 years maybe they get a return of $2,500,000 after the 30 years. But what if the value of the currency itself was devalued more than 5% per year? Did the bank lose money?

The simple answer is: no.

Banks do not lose money when their own currency is being devalued because they are the source of the devaluation. The bank printed the money out of thin air (or more accurately with reserves as collateral). So it doesn't matter if the currency loses value because it was printed out of thin air. $1.5M profit is $1.5M profit no matter how much $1.5M was devalued during the term of the loan. Not so coincidentally this is exactly what creates the inflation to begin with.

In a hyperinflationary scenario where the currency is being devalued 50% per month, the bank can still turn a profit without jacking up interest rates to the inflation level because all the money is being printed out of thin air to begin with. This also has an extreme benefit to the elite who are still allowed to take loans.

If I can take a $1M loan during a hyperinflationary death-spiral it doesn't matter what the interest rate I'm paying is. I'll end up making money because by the time I have to pay back the loan the principal won't be worth anything. If I can take out a loan at 50% APR but the currency is being devalued at 50% per month then after just 1 year the currency has already lost 99.97% of its value and the 50% loan-shark interest rate is meaningless; I can pay back the entire loan for basically nothing as long as I had an asset that maintained its value.

This allows not only the bank to syphon money away from the population it "serves" but also allows all the elites with bank connections to syphon that money as well, which is the only reason why hyperinflation is allowed to happen. If only the bank was profiting in this scenario the powerful people right outside the bank would shut it down instantly.

This is also why foreign banks love to hold US treasuries as their "reserves". There's a reasonable expectation that USD will not hyperinflate. So if your country's currency is losing value but your reserves exist as the dominate world-reserve currency that just means you can print more money because you have more reserves (the money you loaned out is worth less compared to your reserve bag as inflation continues).

For example if I loan out a billion dollars as a bank and I have $200M in USG bonds to collateralize that loan... but then the billion dollars I loaned out loses half its value... that just means I can print out another billion dollars for free and still meet the collateral requirements for my fractional reserve. Neat trick, eh?

Conclusion

Thus is the cycle of unsustainable fractional reserve policies that crypto is supposed to solve, but thus far has been unsuccessful in that endeavor. When money isn't debt and can't be printed out of thin air, hyperinflation can't happen. I even forgot to factor in how technology creates hyperdeflation, so any inflation on top of technological advancements are essentially stealing from all the progress we are making on a scientific level. The ultimate goal of crypto is to turn money into technology so this theft is no longer possible. One day!

Comments