Ethereum Inflation, Supply, Staking, Fees and Other Key Metrics | May 2025

9 comments

How is the Ethereum network doing these days? It has been a rough period for ETH as it has been constantly bleeding against BTC in the last two years. On the other hand, there is now more competition in the space like Solana, BSC, SUI etc that are taking market share.

In the very last days Ethereum has show some signs of recovery against BTC. But still far from its heights.

Since the PoS update the inflation for Ethereum is reduced by 90%, from 4.3% to 0.43%. Additionally, part of the ETH for transactions is burned, that pushed Ethereum into deflationary territory. Meanwhile, the share of staked ETH kept on growing drying up the liquid ETH supply.

Let’s take a look.

Here we will be looking at:

- Overall Supply

- Number Of Wallets

- Active Wallets

- Transactions

- Fees

- Staked ETH

- Contracts

The data presented here is mostly gathered from the etherscan charts and Dune Analytics.

Supply

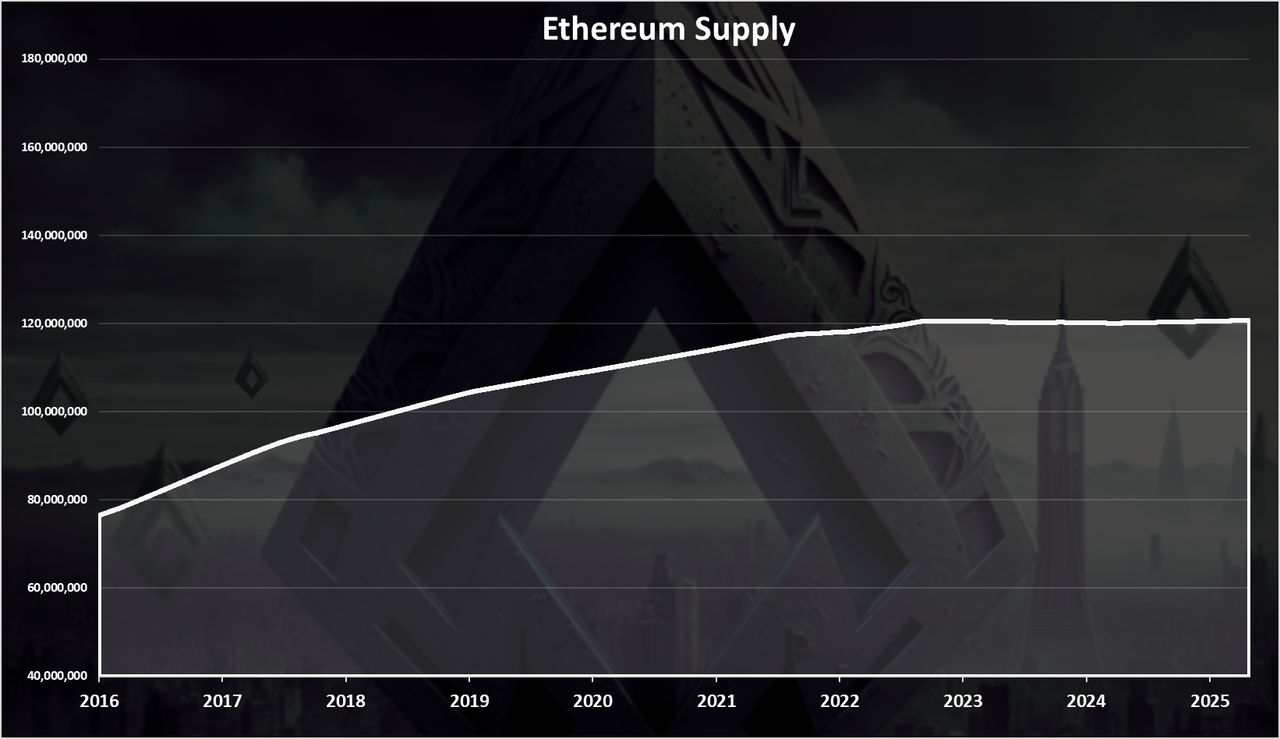

The overall supply now looks like this:

A steady increase in the supply from just above 70M in 2015 to 120M where we are now.

We can see that in the last period after the merge, the supply has been almost stagnant, and even dropped a little.

Ethereum Supply After the Merge

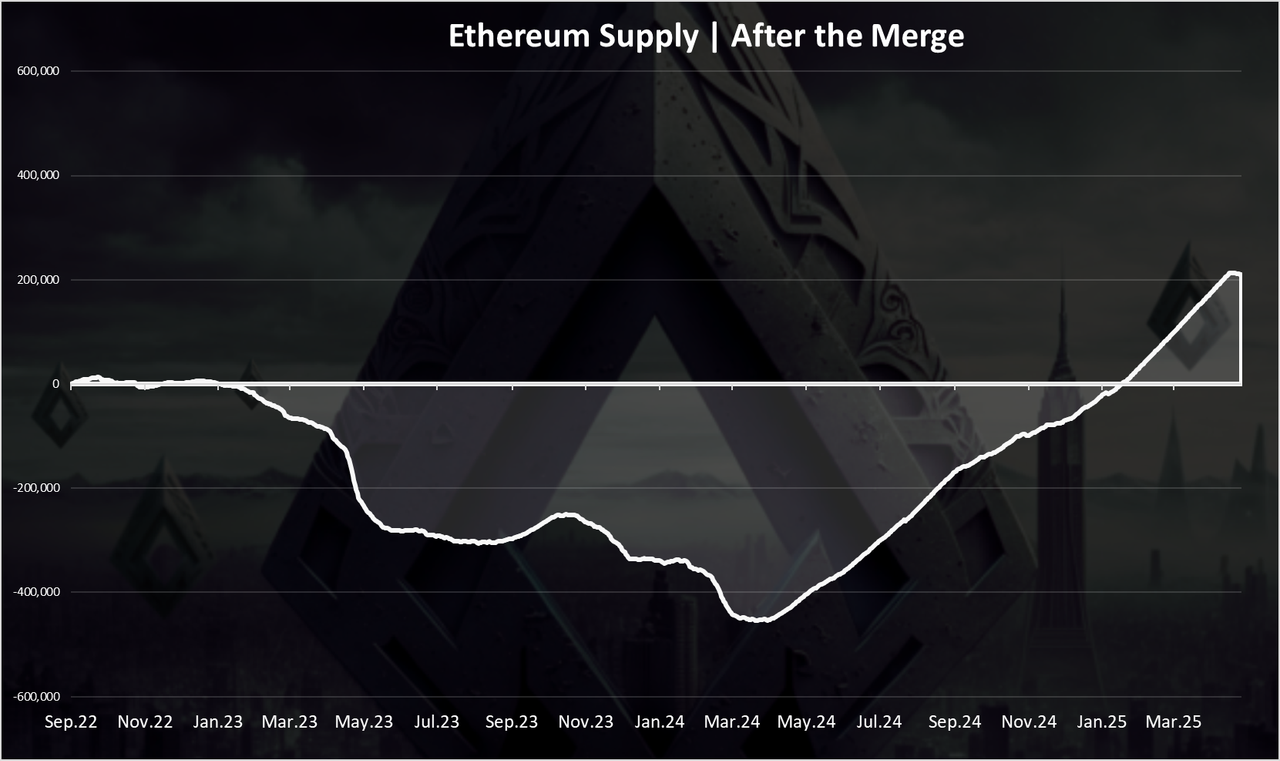

The chart for the new ETH issued after the merge and the transition to proof of stake looks like this.

At first the inflation went down and from September 2022 to March 2024 it has reduced the ETH supply for more than 400k ETH. Then since April 2024 the supply has started growing again due to low activity on chain and not burning enough ETH and has increased for 600k ETH, or cumulative 200k more in the period.

Still even with the latest increase in the supply, for the whole period starting from the merge the overall ETH inflation is close to 0.2%, that is quite a low number when compared to the previous period.

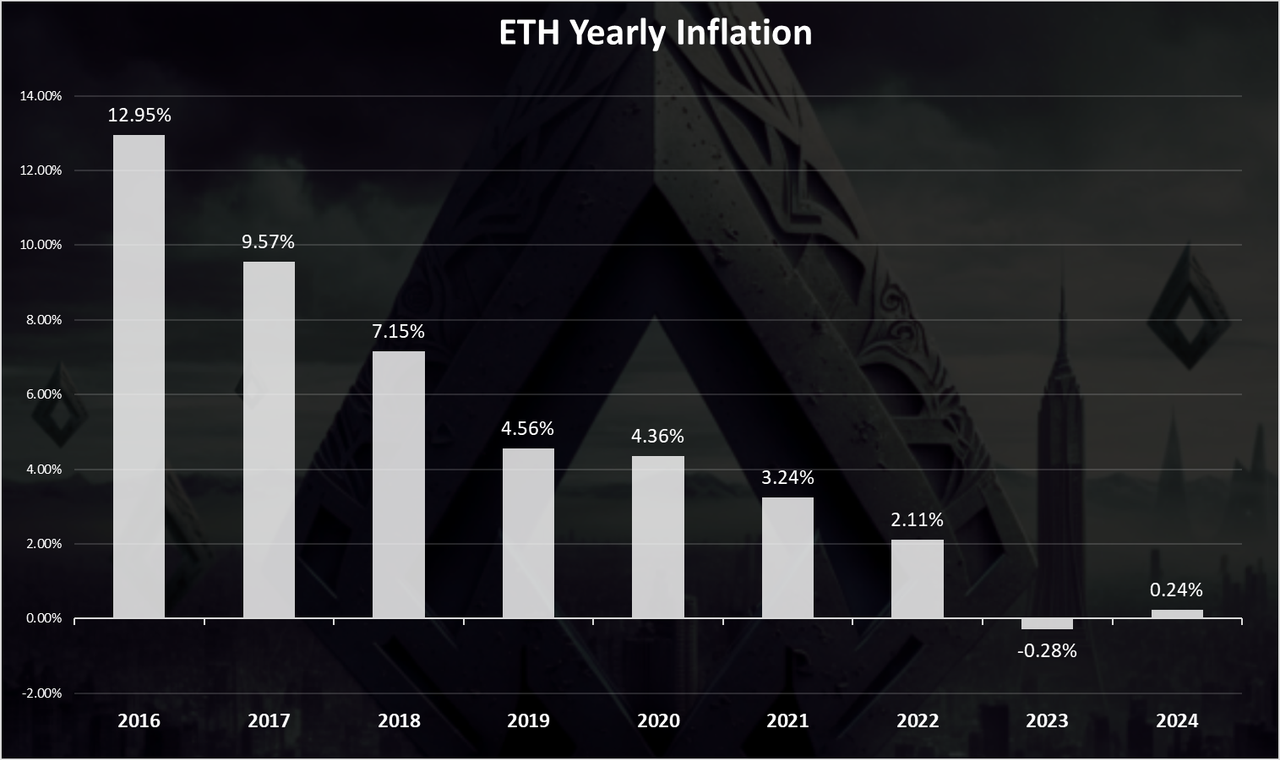

The table for the yearly inflation looks like this.

From more than 10% down to negative -0.28% in 2023. In 2024 the inflation is at 0.24%, still less than the 0.43% base inflation.

Even with positive inflation of 0.24% this is still quite a hard asset, bearing in mind that if we take the last two years it will be at zero.

Number of Wallets

Now for the general network numbers.

Here is the chart for the total number of Ethereum wallets created.

Ethereum now has close to 320M wallets! The numbers of wallets keeps growing at a steady pace.

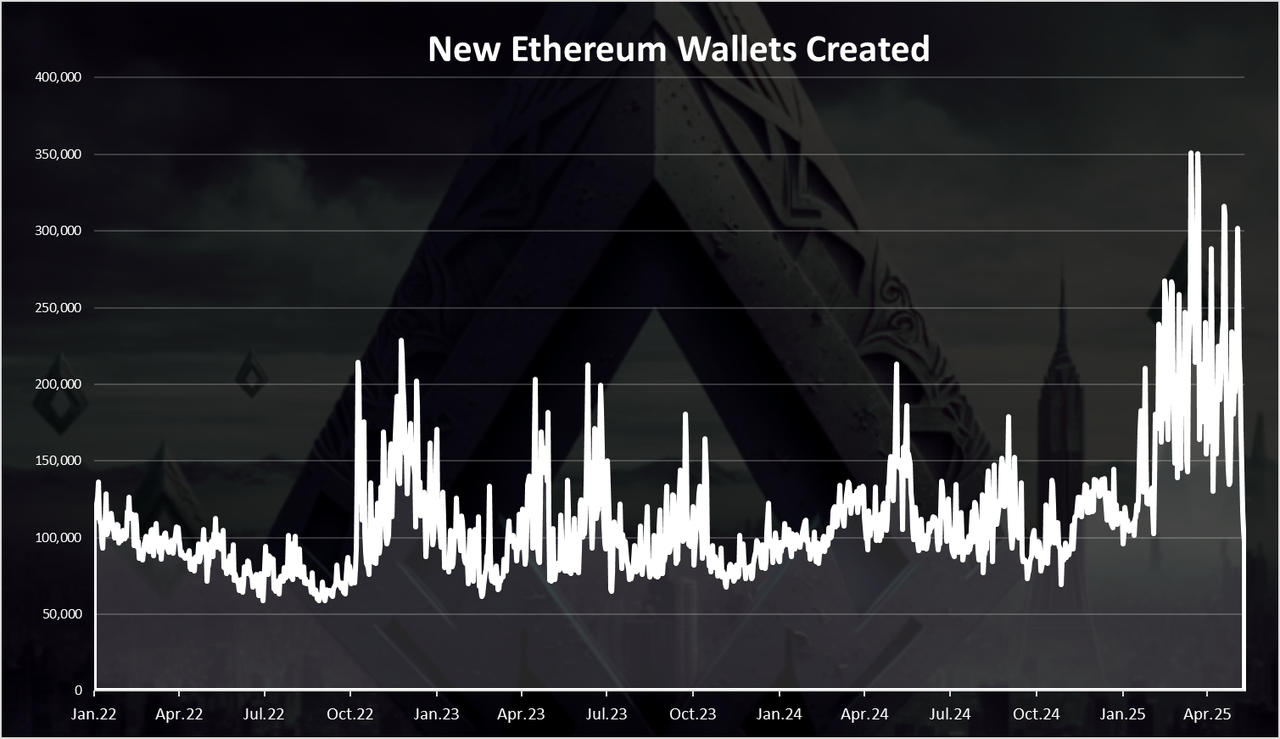

When we look at the number of new daily wallets created we get this chart.

This is starting from 2022.

Some sideways action here but still a relatively steady numbers up until 2025 since when it increased from 150k up to 300k, not sure why.

Note that there is no costs for Ethereum wallets so some of it can be spam.

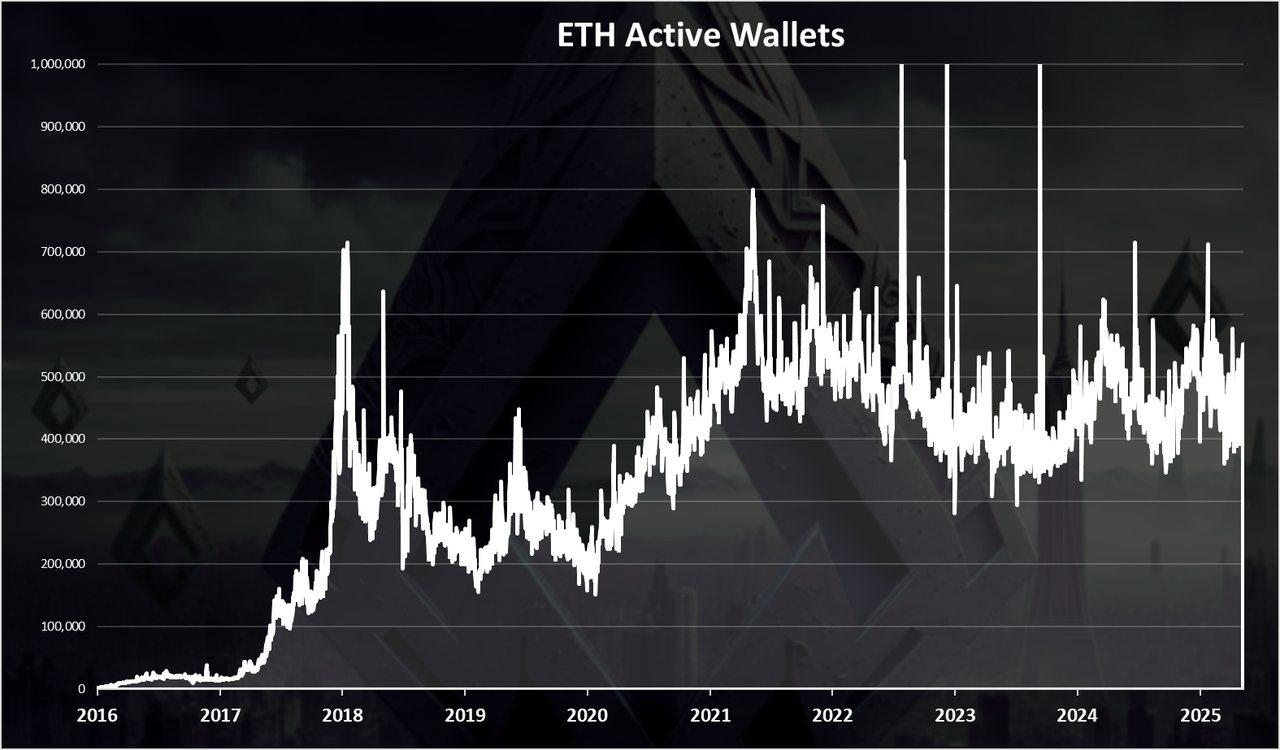

Active Wallets

How many of them are being used?

Here is the chart.

We can see that there was an overall uptrend up until 2021, reaching around 700k active wallets. Since then, there has been a downtrend up to December 2023, when it started growing again, from 400k to 600k active daily wallets.

In the last period the number of active wallets is in the range of 500k to 600k.

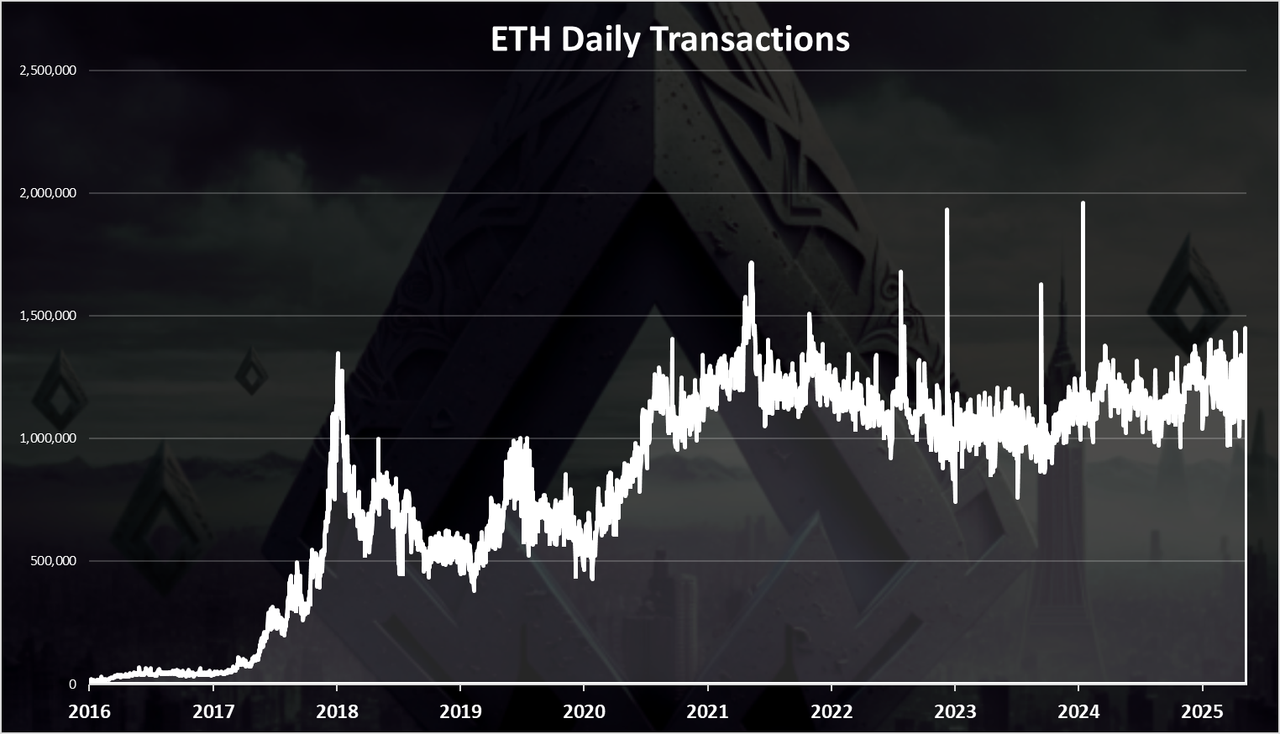

Transactions

How about the number of transactions? Is the Ethereum network now more active after the merge? Here is the chart.

There was a spike in the transactions back in the bull market of 2017, up to 1.4M, then a drop to around 500k per day.

In the previous bull market in 2021 the ATH was somewhere around 1.8M transactions per day, a steady drop since then and a growth again in December 2023, and we are now somewhere around 1.3M transactions per day on the Ethereum network.

Fees

There was misunderstandings that the merge will make the fees on Ethereum smaller. But this is not the case. The merge is a consensus upgrade, not a scalability upgrade.

At first there was a small increase in the fees back in 2017-2018 bull run. Then in the next bull ran a massive increase in the fees up to $100 at one point. A drop in 2022 in the range of 5 to 10 USD, and a further drop in the very last period to bellow one dollar. The current fees on Ethereum are the lowest since 2020.

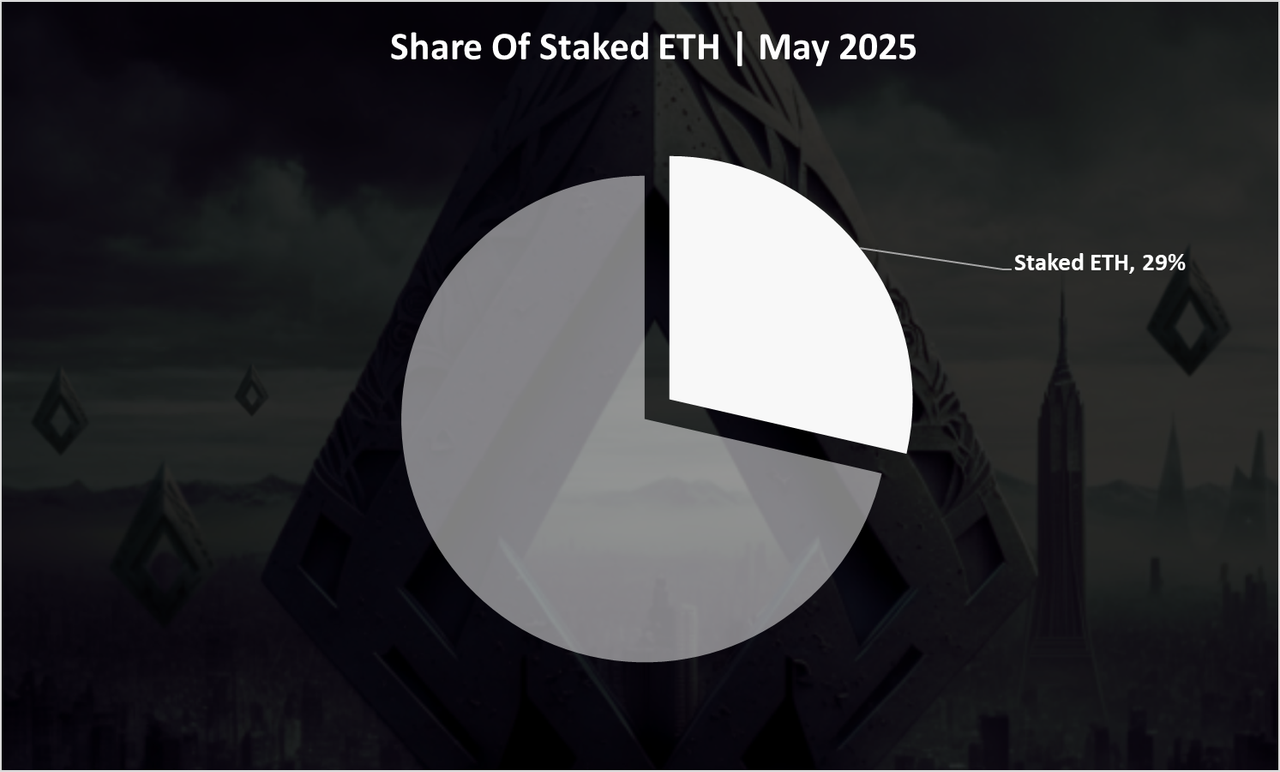

Staking Ethereum

Staking a big topic in the Ethereum network since the PoS upgrade. Here in short will just check the share of ETH staked from the overall supply. Here is the pie.

A 29% staked ETH from all the supply. The trend for the staked ETH has been constantly up in the last period. For a token of this size and market cap this is quite a big share.

Number of Contracts

Here is the chart for the number of smart contracts deployed daily.

There was a peak in the number of contacts back in 2023, and then a drop in 2024, from 1k to around 400 where it has been up until recently when it dropped further to below 100 daily verified contracts on the Ethereum network. Maybe a lot of the sidechains are taking some the share of the contracts.

In summary, while the market has been volatile, the stats on the Ethereum network has been quite constant so to speak. The number of transactions, active wallets, new wallets, have all is a type of stable range. Looks like these numbers have been almost maxed and they stay at those levels. On the other hand fees remain down and the amount of ETH burned is lower then the inflation causing the overall ETH supply to goes slightly up.

All the best

@dalz

Comments