A Look at the Number One L2 on Ethereum - Arbitrum | Data on TVL, Wallets, Active Users, Transactions, Fees and More | September 2024

11 comments

Arbitrum has positioned itself as the number one L2 on Ethereum. It has the most TVL, activity and users.

A ChatGPT short description on Arbitrum:

Arbitrum is a Layer 2 scaling solution for Ethereum designed to improve the network's speed, reduce transaction costs, and enhance overall efficiency without compromising on security. Built on optimistic rollups technology, Arbitrum bundles multiple transactions off-chain and then records them on the Ethereum mainnet, significantly reducing congestion and gas fees. This scaling approach maintains Ethereum's security and decentralization while providing a faster, cheaper, and more efficient environment for decentralized applications (dApps) and smart contracts. Arbitrum's compatibility with existing Ethereum tools and infrastructure makes it easy for developers to deploy applications, fostering a growing ecosystem of DeFi, NFTs, and other blockchain-based solutions.

With this said, let’s take a look at some data.

Let’s take a look at the data on the Base network and see what has been happening in the last period.

The data presented here is mainly from base scan, DeFi Lama and Dune Analytics.

We will be looking at:

- Total Value Locked TVL

- Number of Addresses

- Active Addresses

- Daily Transactions

- Fees

- Contracts

- Price

Total Value Locked

This represents how much of value has been bridged to the Base chain where it seats and is being used in DeFi and other use cases. Here is the chart:

As we can see, for the first time funds started being bridged on Base back In September 2021, when the TVL increased rapidly to 2.7B. A sharp drop in the bear market of 2022 to bellow 1 billion and then a steady growth towards 3B and a new ATH in the recent period. 3B is quite a lot of a L2 in today’s numbers.

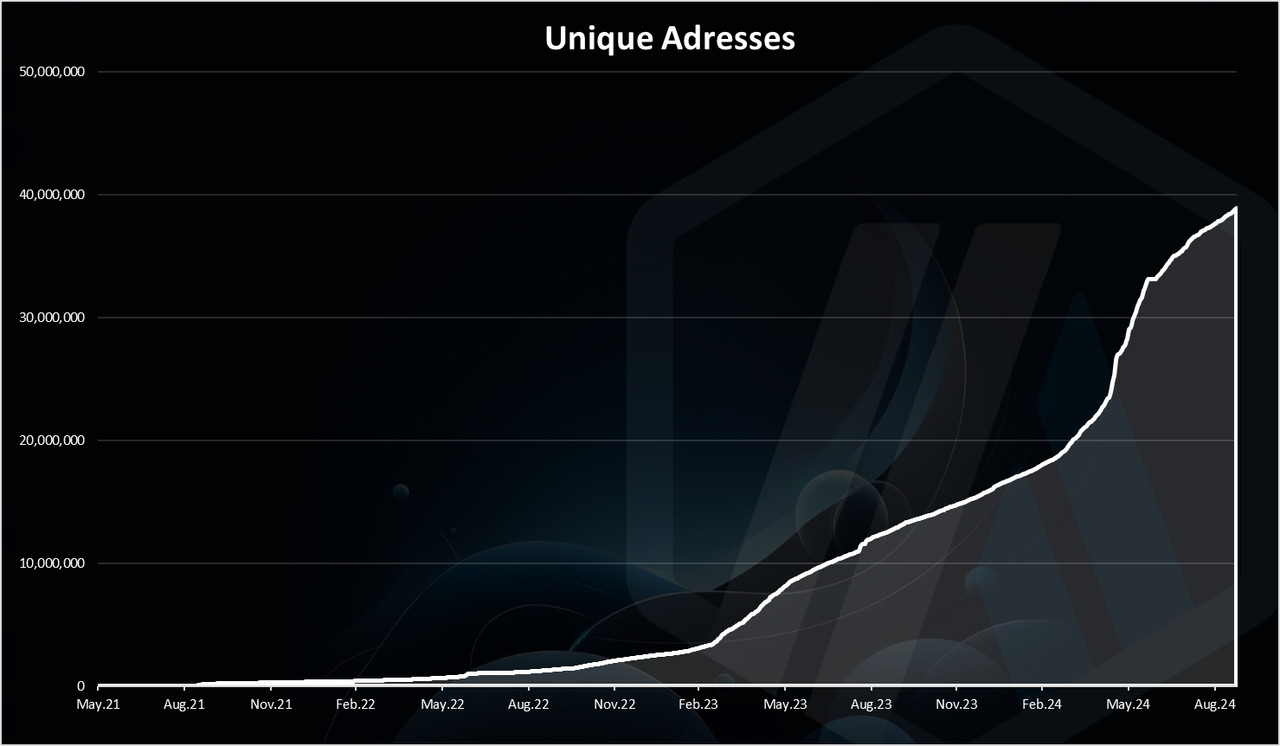

Number of Addresses

One of the key metrics for crypto projects is the number of wallets.

First the overall number of wallets.

We can see that in the first years the number of wallets was low, and then started growing a lot in 2023 and continued to do so up until 2024. A total of 40M wallets at the moment.

For comparison Ethereum has around 280M wallets.

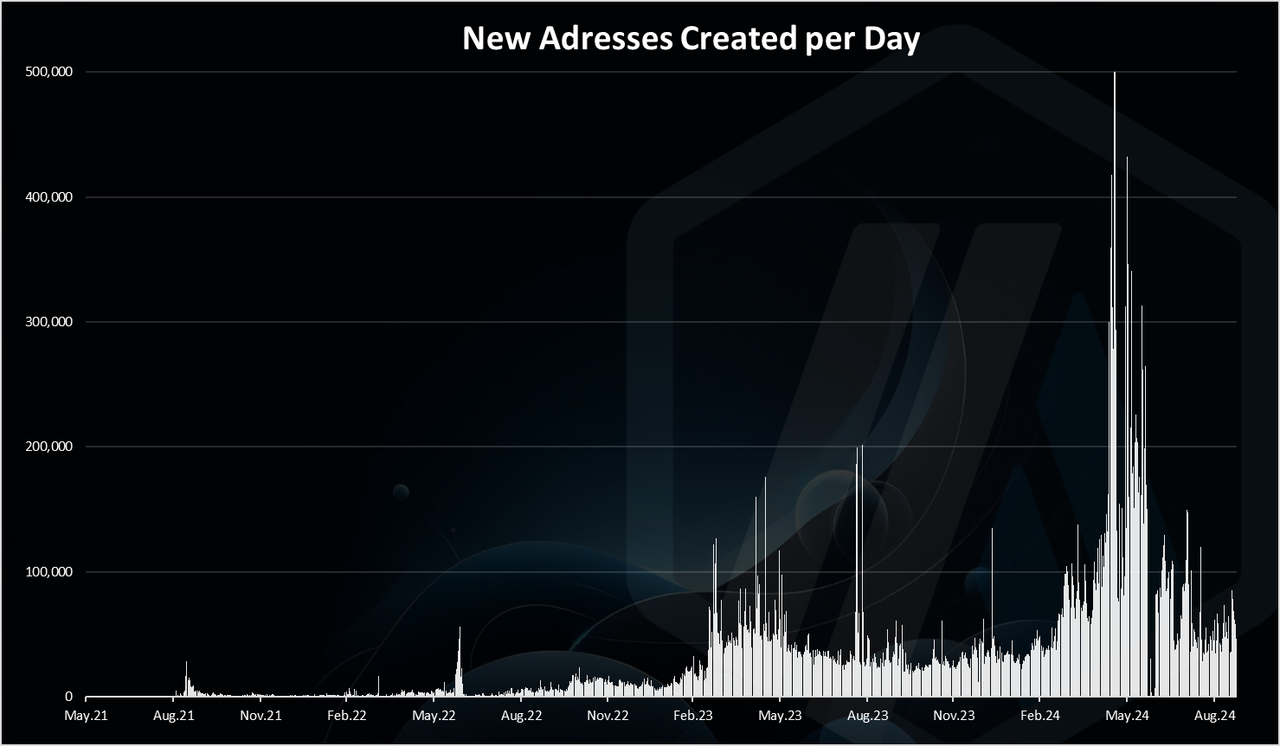

If we take a look at the new daily wallets we get this.

Here we can see the growth in the last two years, especially in May 2024 when on a few occasions there were more than 500k wallets created daily. On average in the last period there are around 50k wallets.

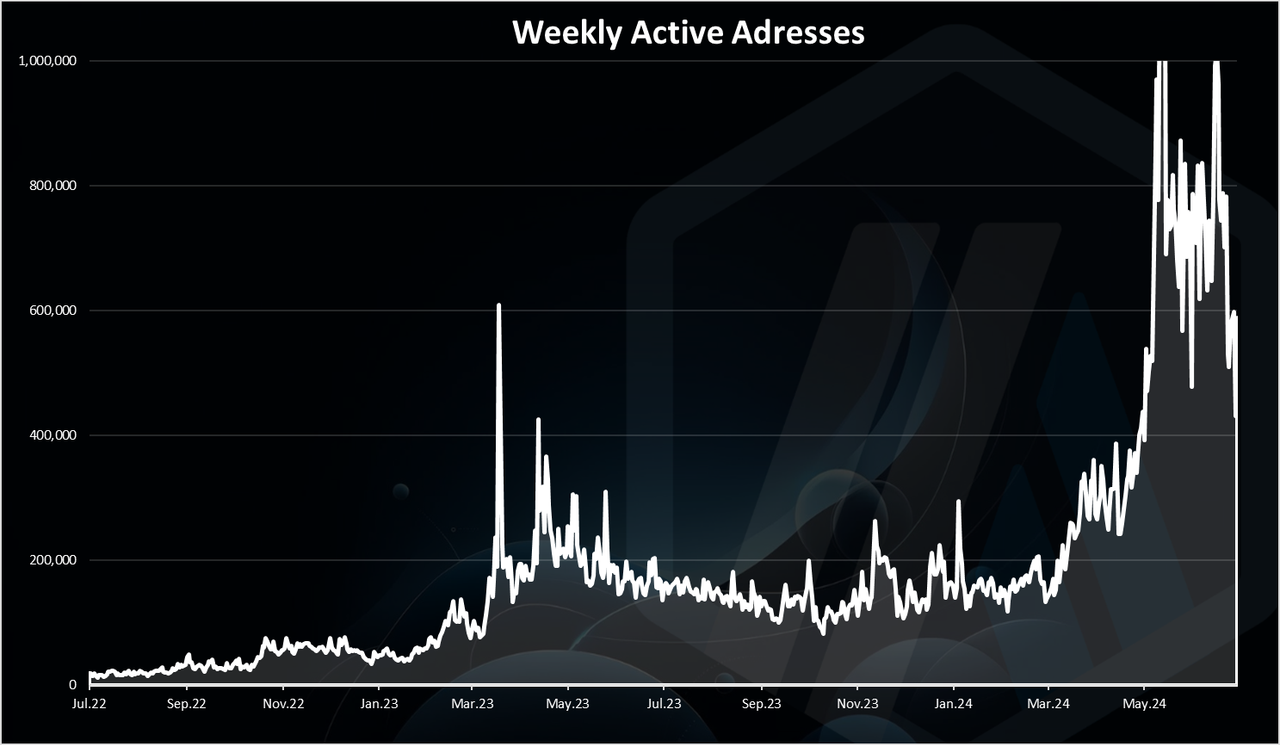

Active Addresses

How many of the wallets created are active? Here is the chart.

This is a weekly number for active wallets. We can see a massive growth in the last period reaching more than 1M WAUs. In the previous period there was around 200k per week.

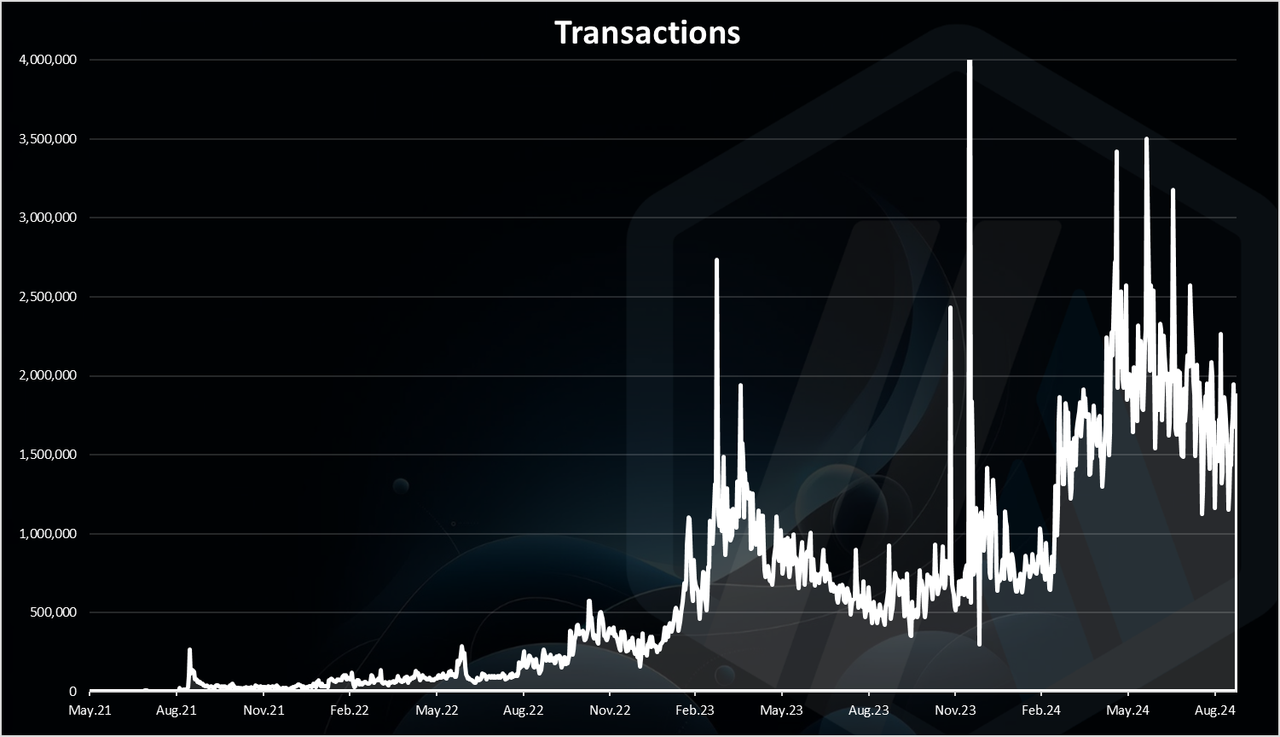

Daily Transactions

The activity on the network is mostly represented by the number of daily transactions.

On the transactions side we can see a similar pater as for the active wallets. A spike in May 2024 and a slow down since then. In the last period the number of daily transactions has been around 2M. In the previous years the number of transactions per day has been in the range of 500k to 1M. So, a significant increase in 2024.

On Ethereum the number of transactions per day is around the 1.2M mark.

Fees

Base is basically promoting itself as a low cost option to Ethereum, but also an easy gateway from the Coinbase exchange. Recently they have even made USDC transactions feeless.

Here is the chart.

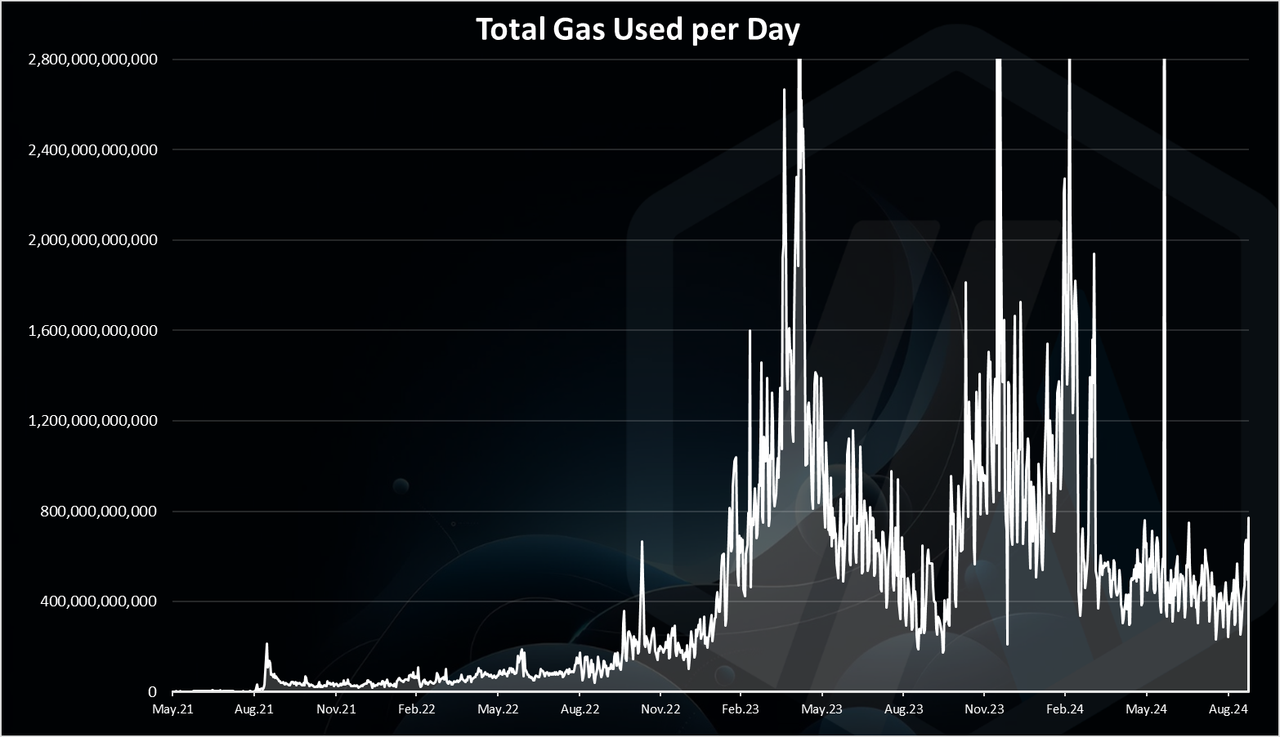

The above long term chart is to represent the trend in the fees. The units are not in dollar terms, as there is no data available. This is the total gas used per day in wei, a subunit of Ethereum. Gas prices on Arbitrum are in ETH, even though the chain has its token ARB.

We can see there was a spike in February 2023, and few other spikes in 2023. In 2024 the gas price has been more constant on Arbitrum.

At the moment the gas fees in dollar terms are very low and are under one cent, somewhere in the range of 0.007$.

Contracts

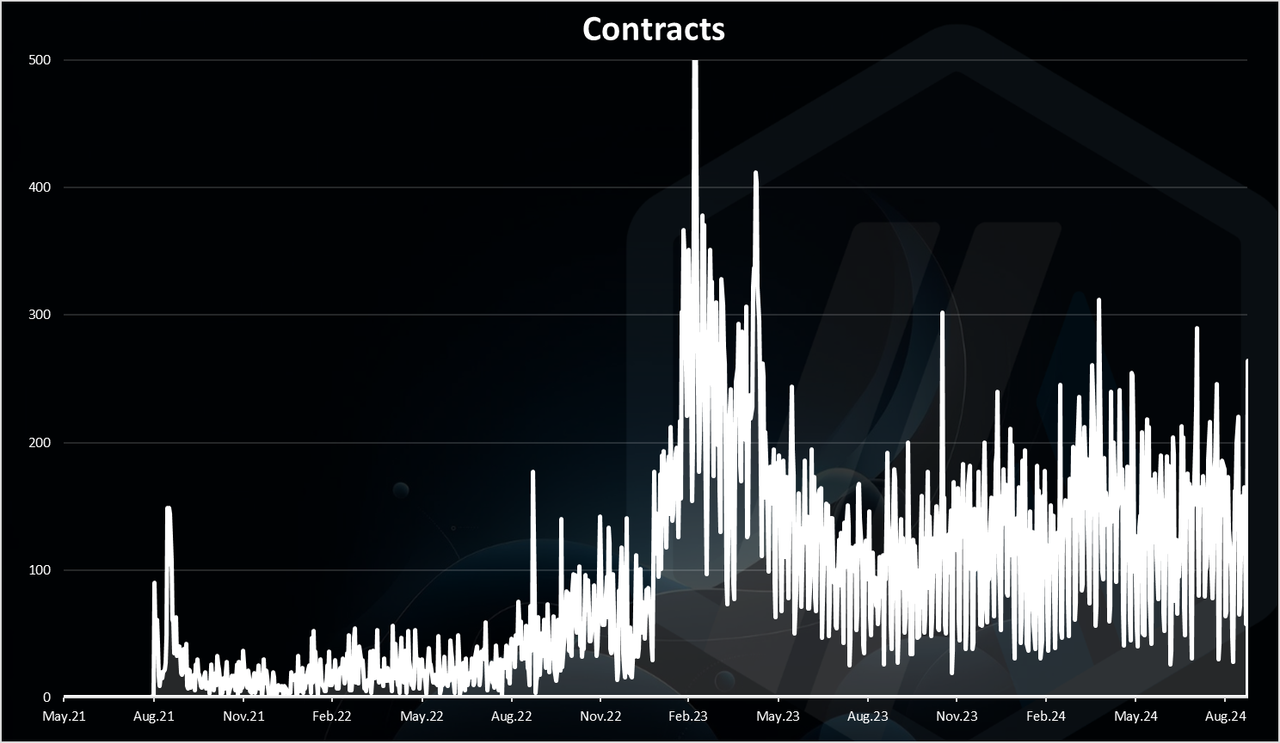

Arbitrum as Ethereum is a smart contract platform so here is the chart for verified contracts per day.

We can notice the first spike in the number of daily contracts back at the beginning of 2023 reaching 500 per day, then a slowdown to around 100 and a slow increase since then to around 150 where we are now.

Price

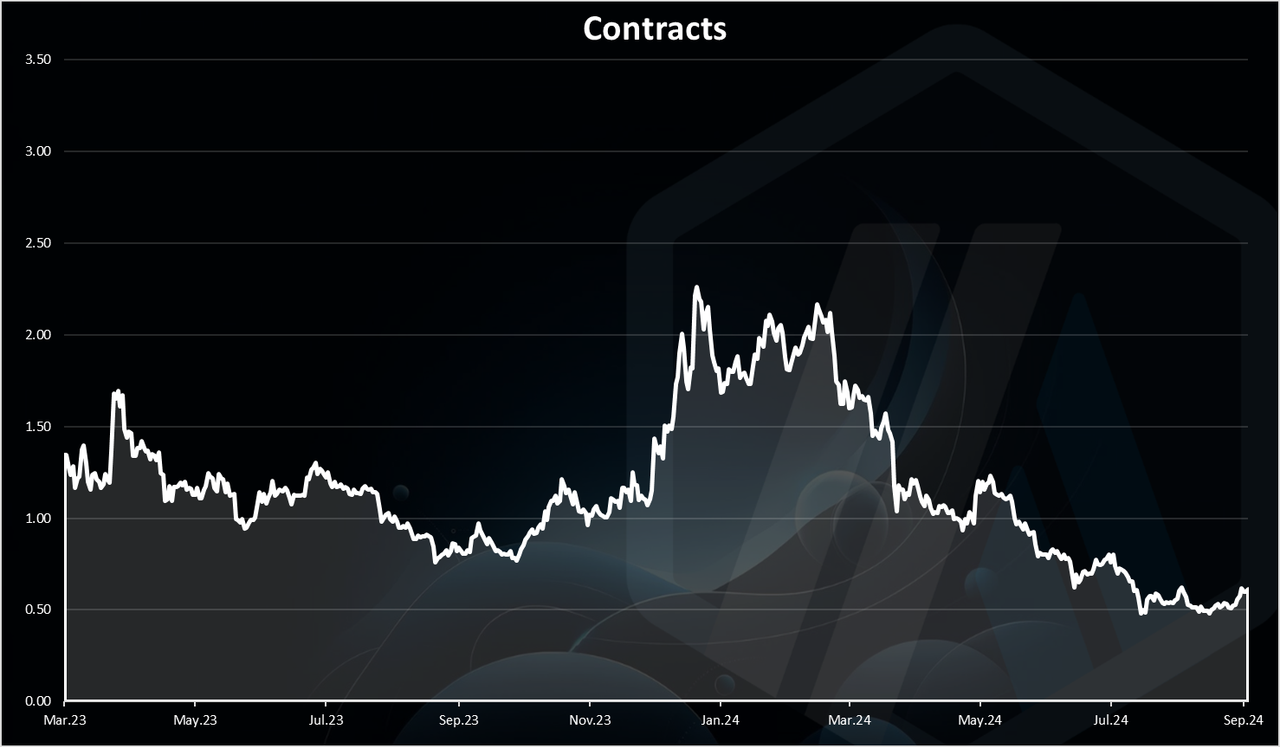

At the end the price of the ARB token. Here is the chart.

The chart for the token prices starts from March 2023. At first it was trading at 1.5USD and then a drop below one dollar and an increase again at the beginning of 2024 reaching new ATH for the token price at $2. A sharp drop since then and the token is now at its all-time low of 0.5. The competition in the L2 chains on ETH has been massive with new chains coming up all the time. Arbitrum has established itself as the number one for now. How it will continue in the future is an open question since things can change very fast in the sector.

All the best

@dalz

Comments